california mileage tax rate

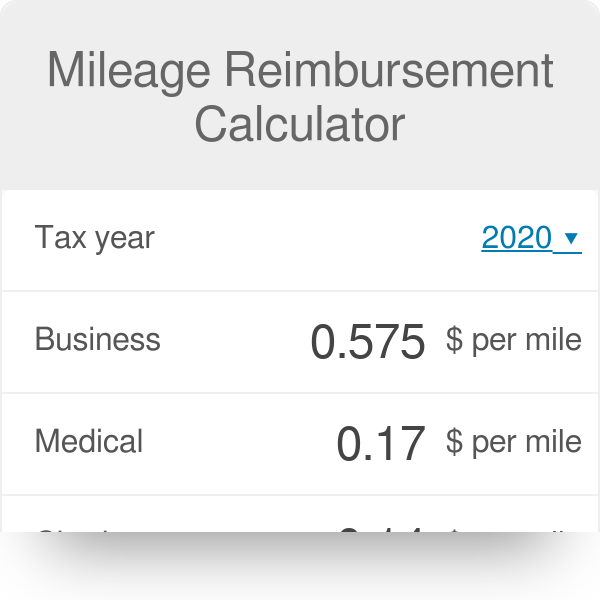

The standard automobile mileage reimbursement rate set by the IRS for 2012 - 555 cents per mile. Have found Florida to.

Free Mileage Reimbursement Form 2022 Irs Rates Pdf Word Eforms

Mileage reimbursement rates do not necessarily.

. 585 cents per mile driven for business use up 25 cents from 2021 rates 18 cents per mile driven for medical or moving purposes for qualified active-duty members of the Armed Forces up 2 cents from 2021 rates and. What is the mileage rate for 2020 in California. The federal tax for gasoline has been 184 cents per gallon since 1993.

Online videos and Live Webinars are available in. Heres a breakdown of the current IRS mileage reimbursement rates for California as of January 2020. This means that they levy a tax on every gallon of fuel sold.

However if an employers policy sets a higher per-mile reimbursement rate they may pay the higher amount. An extra 1 may apply. December 11 2017 633 PM CBS San Francisco.

Unless otherwise stated in the applicable MOU the personal aircraft mileage reimbursement rate is 1515 per statute mile. The standard mileage rate that businesses use to pay tax-free reimbursements to employees who drive their own cars for business will be 585 cents per mile in 2022 up 25 cents from 2021 the IRS. Rates 11 through 6302022 Rates 71 through 12312022.

Today this mileage tax. According to SmartAsset in. For the final 6 months of 2022 the standard mileage rate for business travel will be 625 cents per mile up 4 cents from the rate effective at the start of the year.

Additionally taxpayers earning over 1M are subject to an additional surtax of 1 making the effective maximum tax rate 133 on income over 1 million. This is why gas prices in say San Francisco California are different than in a place like Atlanta Georgia. According to the CDTFA 25 different sales tax rates are charged across Californias cities.

Motor Vehicle Fuel Tax Law RT Code Section 7392 Rate of Tax The tax is imposed upon every aircraft jet fuel dealer at the rate of 002 for each gallon the aircraft jet fuel sold to an aircraft jet fuel user or used by the dealer as an aircraft jet fuel user. 14 cents per mile driven in service of charitable organizations. 14 cents per mile.

20 cents per mile driven for medical or moving purposes up 2 cents from 2018. Beginning on January 1 2022 the standard mileage rates for the use of a car also vans pickups or panel trucks will be. At a miles per gallon figure of 25 that means that at 119 per gallon the state fed sales tax plus fees like cap and trade total a typical motorist will pay 618 per year or 48 cents a mile in taxes.

In California Jet Fuel is subject to a state excise tax of 002 per gallon Point of Taxation. 18 cents per mile. The standard automobile mileage reimbursement rate set by the IRS for 2011 Jul-Dec - 555 cents per mile.

18 cents per mile driven for medical or moving purposes for qualified active-duty members of the Armed Forces up 2 cents from the rate for 2021 and. If you have questions you can contact the Franchise Tax Boards tax help line at 1-800-852-5711 or the automated tax service line at 1-800-338-0505. Californias Proposed Mileage Tax.

For example right now and these are general AVERAGES Californians drive each personal car about 13000 miles per year. SAN FRANCISCO KPIX 5 -- California is moving closer to charging drivers for every mile they drive. The cost of maintenance oil lube routine maintenance Insurance liability damage comprehensive and collision coverage Licensing and registration.

4035 Transactions Not Subject to. 585 cents per mile. 58 cents per mile for business miles driven up 35 cents from 2018.

Traditionally states have been levying a gas tax. 4025 Partial Use Tax Exemption. 4015 Credit for Tax Paid to Another State.

The state says it needs more money for road. Keep in mind states can also impose other fees and taxes at the pump. 4005 California Department of Tax and Fee Administration Review Request.

The rate is unchanged from 2021. I have been resisting against all common sense leaving California completely. The new rate for deductible medical or moving expenses available for active-duty members of the military will be 22 cents for the remainder of 2022 up 4 cents from the rate effective at the start of 2022.

14 cents per mile. 4010 Calculating Use Tax Amount. For questions about filing extensions tax relief and more call.

The standard automobile mileage reimbursement rate set by the IRS for 2013 - 565 cents per mile. Please contact the local office nearest you. 625 cents per mile.

California will be losing another tax payer between all taxes to the statecounty I pay about 12kyear. The money so collected is used for the repair and maintenance of roads and highways in the state. CDTFA public counters are now open for scheduling of in-person video or phone appointments.

I dont want to sell my home but it is time. Interest is computed on overdue taxes in each jurisdiction at a rate of 4167 per month. Heres who must pay California state tax whats taxable.

California also pumps out the highest state gas tax rate of 6698 cents per gallon followed by Illinois 5956 cpg Pennsylvania 587 cpg and New Jersey 507 cpg according to. 4030 Refund of Use Tax. As of January 2021 the Internal Revenue Service slightly decreased the required reimbursement rate per mile from 0575 cents per mile to 056 cents per mile.

Employees will receive 575 cents per mile driven for business use. State gasoline taxes vary. California has announced its intention to overhaul its gas tax system.

Depreciation and all other costs associated with operation of the vehicle Short-Term. 22 cents per mile. 14 cents per mile driven in service of charitable organizations.

California state tax rates are 1 2 4 6 8 93 103 113 123.

An Employer S Guide To Car Allowance Travelperk

Your Guide To California Mileage Reimbursement Laws 2020

County City Leaders Push Back Against Proposed Mileage Tax

California S Road Usage Charge Pilot Program Stirs Controversy The Coast News Group

Your Guide To California Mileage Reimbursement Laws 2020

Irs Raises Standard Mileage Rate For 2022

California Employers Association 2022 Irs Mileage Rate Is Up From 2021

How The Irs Mileage Rate Violates Ca Labor Code 2802 A

Cra Mileage Rate For Self Employed Canadians 2022 Guide

Mileage Reimbursement A Complete Guide Travelperk

What Are The Mileage Deduction Rules H R Block

We Ll Need To Replace The Gas Tax In Transition To Zevs Calmatters

Free Mileage Reimbursement Form 2022 Irs Rates Pdf Word Eforms

Deductible Mileage Rate For Business Driving Increases For 2022 Sol Schwartz

Sandag S Proposed Road Charge Would Piggyback On California S Plans For A Per Mile Driver Fee The San Diego Union Tribune

Mileage Reimbursement Calculator

Vehicle Mileage Tax Could Be On The Table In Infrastructure Talks Buttigieg Says